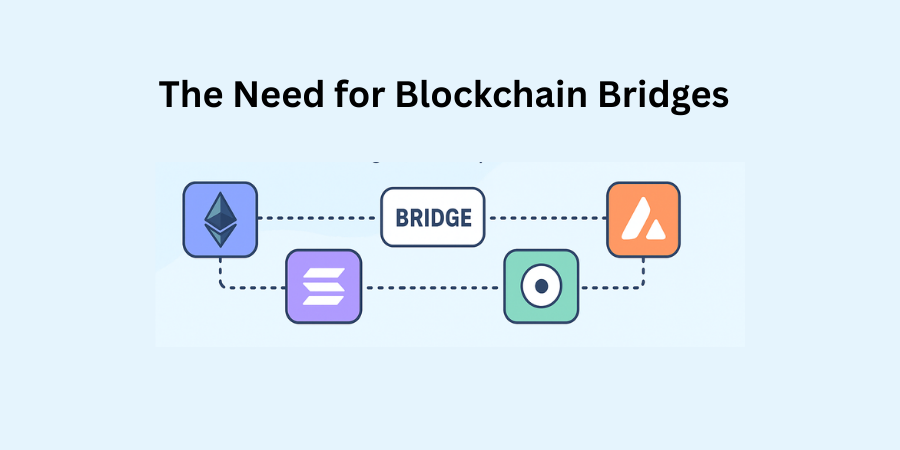

Introduction: The Need for Blockchain Bridges

As the blockchain ecosystem grows, hundreds of networks (Ethereum, Solana, Avalanche, etc.) operate in isolation. Interoperability solutions—bridges—allow these chains to communicate, enabling:

- Cross-chain asset transfers (e.g., ETH → Solana)

- Multi-chain dApps (DeFi protocols on multiple networks)

- Scalability solutions (Moving assets to faster chains)

However, bridges also introduce security risks, as seen in major hacks like the Ronin Bridge ($625M exploit).

This guide explains:

- How blockchain bridges work

- Different types of bridges (trusted vs. trustless)

- Key risks and future innovations

1. What Is a Blockchain Bridge?

Definition

A blockchain bridge is a protocol connecting two or more blockchains, allowing the transfer of assets and data between them.

Why Are Bridges Important?

- Asset portability: Use Bitcoin on Ethereum via wrapped BTC (WBTC).

- Scalability: Move assets from Ethereum to Layer 2s (Arbitrum, Optimism).

- Ecosystem growth: Developers can build multi-chain applications.

Example:

- Wrapped Bitcoin (WBTC) lets users trade Bitcoin on Ethereum DeFi apps.

2. How Do Blockchain Bridges Work?

Step-by-Step Process (Token Transfer Example)

- User locks Token A on Chain A (e.g., ETH on Ethereum).

- Bridge validates the transaction (via smart contracts or oracles).

- Equivalent Token B is minted on Chain B (e.g., WETH on Polygon).

- User receives Token B and can use it on Chain B.

- To redeem, Token B is burned, and Token A is unlocked.

Technical Mechanisms

- Lock-and-Mint: Assets are locked on one chain and minted on another.

- Burn-and-Mint: Assets are burned on one chain and minted on another.

- Atomic Swaps: Peer-to-peer cross-chain trades without intermediaries.

3. Types of Blockchain Bridges

A. Trusted (Centralized) Bridges

- How they work: Rely on a central custodian (e.g., Binance Bridge).

- Pros: Fast, user-friendly.

- Cons: Requires trust in a third party (custodial risk).

B. Trustless (Decentralized) Bridges

- How they work: Use smart contracts and cryptographic proofs (e.g., Rainbow Bridge).

- Pros: No single point of failure.

- Cons: Slower, complex to implement.

Comparison Table

| Feature | Trusted Bridges | Trustless Bridges |

|---|---|---|

| Security Model | Custodial | Non-custodial |

| Speed | Fast | Slower (consensus delays) |

| Examples | Binance Bridge, WBTC | Connext, Hop Protocol |

4. Major Blockchain Bridges in Use

| Bridge | Chains Supported | Type |

|---|---|---|

| Polygon PoS Bridge | Ethereum ↔ Polygon | Trusted |

| Wormhole | Solana, Ethereum, BSC | Hybrid |

| Arbitrum Bridge | Ethereum ↔ Arbitrum | Trustless |

| Cosmos IBC | Cosmos SDK chains | Trustless |

5. Risks and Challenges

Security Vulnerabilities

- Smart contract bugs (e.g., Nomad Bridge hack – $190M lost).

- Validator attacks (e.g., Ronin Bridge exploit – $625M stolen).

Other Challenges

- Liquidity fragmentation (Assets stuck on multiple chains).

- Centralization risks (Trusted bridges control funds).

How to Stay Safe

- Use audited bridges (Check DeFi Llama or Bridge Score).

- Prefer trustless bridges when possible.

- Avoid holding assets on bridges long-term.

6. The Future of Interoperability

Emerging Solutions

- Cross-Chain Messaging (CCM): Protocols like LayerZero enable seamless dApp communication.

- ZK-Bridges: Use zero-knowledge proofs for secure transfers (e.g., zkLink).

- Universal Chains: Polkadot and Cosmos aim to be “blockchain internet” hubs.

Long-Term Vision

A fully interoperable blockchain ecosystem where:

- Users move assets freely across chains.

- dApps leverage multiple networks seamlessly.

Conclusion

Blockchain bridges are essential for interoperability, but they come with risks. Key takeaways:

- Trustless bridges are safer but slower.

- Trusted bridges are convenient but risky.

- Future innovations (ZK-proofs, cross-chain messaging) will improve security.

Have you used a blockchain bridge? Share your experience below!