Introduction

Initial Coin Offerings (ICOs) have been a popular way for blockchain projects to raise funds since Ethereum’s groundbreaking ICO in 2014. While they carry risks, ICOs also offer early investors the chance to get in on the ground floor of promising crypto projects.

But how do you participate safely? This guide will cover:

- What an ICO is and how it works

- Step-by-step instructions for joining an ICO

- Red flags to avoid scams

- Post-ICO steps to secure your investment

By the end, you’ll know how to evaluate and invest in ICOs wisely.

What Is an Initial Coin Offering (ICO)?

An ICO is a fundraising method where a blockchain project sells its native tokens to early investors in exchange for BTC, ETH, or other cryptocurrencies.

ICO vs. IPO vs. IDO

| Fundraising Method | Key Features |

|---|---|

| ICO | Token sale, open to public, high risk/reward |

| IPO (Stock Market) | Regulated, requires approval, traditional investors |

| IDO (DEX Launch) | Instant liquidity, decentralized, less regulatory risk |

Why Do Projects Launch ICOs?

- Raise capital for development

- Distribute tokens to early supporters

- Build a decentralized community

Step-by-Step Guide to Participating in an ICO

Step 1: Research the ICO Thoroughly

Before investing, verify:

- Whitepaper – Does it explain the project’s purpose and tech?

- Team – Are founders doxxed (publicly known) with blockchain experience?

- Tokenomics – What’s the max supply? Allocation for investors?

- Community & Hype – Check Telegram, Twitter, and Reddit discussions.

Research Tools:

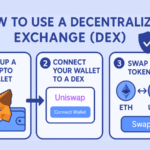

Step 2: Set Up a Secure Wallet

Most ICOs require sending ETH, BTC, or USDT from a self-custody wallet like:

- MetaMask (Ethereum-based ICOs)

- Trust Wallet (Multi-chain support)

- Ledger/Trezor (Hardware wallets for extra security)

Never send funds directly from an exchange (Binance, Coinbase).

Step 3: Register for the ICO (If Required)

Some ICOs require:

- KYC Verification (ID submission)

- Whitelist Sign-Up (Early access)

Example:

- Visit the official ICO website (double-check URL!)

- Complete KYC (if needed)

- Get whitelisted before the sale starts

Step 4: Send Funds to the ICO Address

- Wait for the official start time (scammers create fake countdowns).

- Send only the accepted cryptocurrency (e.g., ETH).

- Use the exact amount specified (some ICOs reject incorrect deposits).

Triple-check the wallet address! (Copy-paste, don’t type manually.)

Step 5: Receive & Secure Your Tokens

- Tokens may be distributed immediately or locked for vesting.

- Add the token contract address to your wallet (available on the ICO website).

How to Add a Custom Token in MetaMask:

- Click “Import Token”

- Paste the contract address

- Confirm symbol & decimals

5 Red Flags of ICO Scams

Many ICOs turn out to be exit scams or worthless projects. Watch for:

- Anonymous Team – No LinkedIn or prior experience.

- Unrealistic Returns – “Guaranteed 10X profits!”

- No Working Product – Just a whitepaper, no prototype.

- Fake Partnerships – Claims ties to big companies (Google, Tesla) without proof.

- High Pressure Tactics – “Last chance to buy before price spikes!”

Notable Scam Example:

- Bitconnect (2017) – Promised insane returns, collapsed in 2018.

Post-ICO: What to Do Next?

1. Track Your Investment

- Monitor project updates (Twitter, Discord).

- Check token listings (CoinMarketCap, CoinGecko).

2. Decide: Hold, Trade, or Exit?

- Hold if the project has long-term potential.

- Trade if the token pumps at launch (take profits).

- Exit if red flags emerge (delays, team silence).

3. Secure Your Tokens

- Move them to a hardware wallet (Ledger, Trezor).

- Beware of dusting attacks (scammers send small amounts to track you).

Conclusion: Invest Wisely in ICOs

ICOs can be high-risk, high-reward opportunities. To maximize success:

- Research thoroughly before investing.

- Use a secure wallet (never an exchange).

- Beware of scams (anonymous teams, hype without substance).

- Have an exit strategy (don’t blindly HODL).

Remember: Most ICOs fail—only invest what you can afford to lose.