Introduction

Decentralized exchanges (DEXs) are revolutionizing how people trade cryptocurrencies. Unlike traditional exchanges (like Binance or Coinbase), DEXs let you trade directly from your wallet—no sign-ups, no KYC, and full control over your funds.

But how do you start using them safely? This guide will walk you through:

- What DEXs are and why they matter

- Step-by-step instructions for trading on DEXs

- Security tips to avoid common risks

By the end, you’ll be ready to trade peer-to-peer with confidence!

What Is a Decentralized Exchange (DEX)?

A DEX is a cryptocurrency exchange that operates without a central authority. Instead of relying on a company to hold your funds, trades happen directly between users via smart contracts.

Key Features of DEXs

- No KYC – Trade anonymously

- Non-custodial – You control your private keys

- Global access – No geographic restrictions

- Supports new tokens early – Trade before listings on centralized exchanges

Popular DEX Platforms (2024)

| DEX | Blockchain | Key Feature |

|---|---|---|

| Uniswap | Ethereum, Arbitrum, others | Largest liquidity, user-friendly |

| PancakeSwap | BNB Chain | Low fees, high-yield farming |

| dYdX | Ethereum (Layer 2) | Advanced trading (leverage, limit orders) |

| Jupiter | Solana | Fast, low-cost swaps |

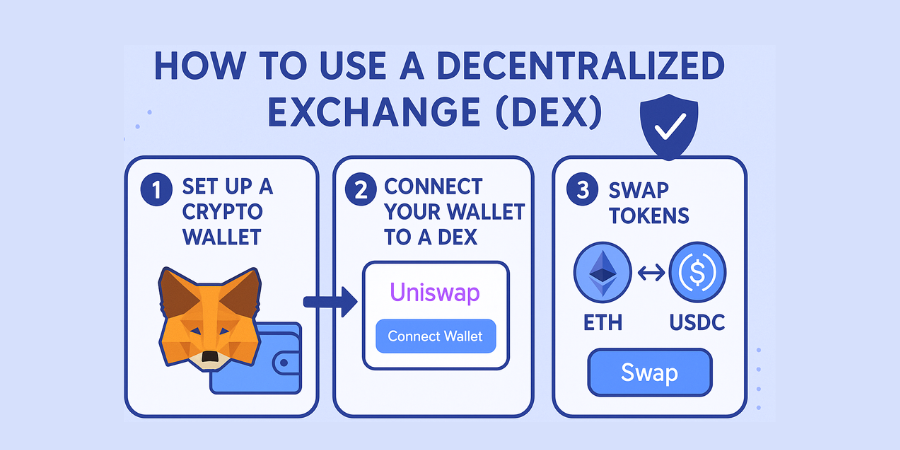

How to Use a DEX (Step-by-Step Guide)

Step 1: Set Up a Crypto Wallet

Since DEXs don’t hold your funds, you need a self-custody wallet like:

- MetaMask (Ethereum, Arbitrum, etc.)

- Phantom (Solana)

- Trust Wallet (Multi-chain)

How to Install MetaMask:

- Download from metamask.io (avoid fake sites!)

- Create a wallet & back up your seed phrase (never share it!)

- Add funds via a bank transfer, exchange deposit, or crypto purchase

Step 2: Connect Your Wallet to a DEX

- Visit a DEX (e.g., Uniswap)

- Click “Connect Wallet” (top-right corner)

- Select your wallet (e.g., MetaMask) and approve the connection

Always verify the website URL (scammers create fake DEX sites!)

Step 3: Swap Tokens (Example: ETH to USDC)

- Select ETH (from) and USDC (to)

- Enter the amount

- Check slippage tolerance (1-3% for stablecoins, higher for volatile tokens)

- Click “Swap” and confirm in your wallet

Use “Expert Mode” (if available) to speed up trades (but increases risk).

Step 4: Provide Liquidity (Earn Fees)

Some DEXs (like Uniswap) let you earn passive income by depositing tokens into liquidity pools.

How to Add Liquidity:

- Go to the “Pool” tab

- Select two tokens (e.g., ETH/USDC)

- Deposit an equal value of both

- Receive LP tokens (representing your share)

Impermanent Loss Risk: If token prices shift, you may lose value compared to holding.

DEX vs. CEX: Which Is Better?

| Feature | DEX | CEX (Binance, Coinbase) |

|---|---|---|

| Control | You hold funds | Exchange holds funds |

| Fees | Network gas fees + swap fees | Trading fees + withdrawal fees |

| Speed | Depends on blockchain | Instant (off-chain matching) |

| KYC | No | Yes |

| Token Listings | Early access | Longer approval process |

Best for DEXs: Privacy, new tokens, DeFi integrations

Best for CEXs: Beginners, high liquidity, fiat on/off ramps

Security Risks & How to Avoid Them

1. Smart Contract Risks

- Some tokens have malicious code (e.g., “honeypot” scams where you can’t sell).

Fix: Check tokens on Token Sniffer before buying.

2. Phishing & Fake DEX Sites

- Scammers create fake versions of Uniswap, PancakeSwap.

Fix: Bookmark official sites & never Google search for DEXs.

3. Slippage & Price Impact

- Large trades can move prices (especially in low-liquidity pools).

Fix: Split big trades into smaller chunks.

Advanced DEX Strategies

1. Limit Orders (Using 1inch, dYdX)

Some DEXs let you set buy/sell at specific prices (like a CEX).

2. Sniping New Tokens

- Monitor CoinGecko New Listings or DEX screener tools.

High risk—many new tokens are scams or pump-and-dumps.

3. Arbitrage Trading

- Profit from price differences between DEXs and CEXs.

(Requires fast execution & gas fee optimization.)

Conclusion: Trade Safely & Take Control

DEXs give you true financial freedom, but with great power comes great responsibility.

Key Takeaways:

- Always use a secure wallet (MetaMask, Phantom, etc.)

- Double-check URLs to avoid phishing scams

- Start small to learn before making big trades

- Provide liquidity cautiously (beware impermanent loss)

Connect your wallet to Uniswap or PancakeSwap and make your first trade today!